About 4 months ago my dad asked me to help him fashion Investor Spotlight into something that would allow him to transfer his knowledge to other investors out there. I've had a lot of success using SCRUM for everything from software development to marketing campaigns so I knew it would be a good fit here as well.

Turning Practice Into Process

My first thought was to get as much of his system written down as possible and go from there! Step 1 in documenting his system was taking a closer look at how he oriented his day to day activity. So, we made a fresh pot of coffee, sat down at my dining room table and got cracking. I essentially interviewed him for the entire day and had him walk through his entire routine from start to finish. I asked him questions when he started getting too technical and I made sure I understood one aspect fully before moving to the next.

Once we had written everything down, several key things jumped out:

- He had designed a complex (and very effective) system for picking high probability growth stocks - without even realizing it

- In action, his process operated as a funnel that mitigated his risk on every trade

- It's possible to teach this method

- Anyone can start using this method with only a few weeks of practice

Once we had that ironed out, we used SCRUM to start building out his mentoring services and in just a few weeks, we had his first student enrolled!

If you're interested in learning his proven system, we can show you how it's done. Just email us at investorspotlight@gmail.com and schedule a quick call or a lunch meeting with us. We'll explain all of the basics and if it's a good fit, you can join our mentoring program!

How SCRUM Made My Dad a Better Investor

My dad realized one additional benefit as a result of this new approach. He started using elements of SCRUM in his own life and, as a result, became an even better investor!

A strong point of SCRUM is that it forces you to ask yourself is there a better way to do this? and the answer is usually yes. Case in point, I watched my dad sit down on a Saturday afternoon and tried my best to document everything that went into his watch list building routine.

I noticed that he took all of his notes by hand, shuffled between multiple publications, and reviewed a number of different screens and charts on his computer. I let him finish his routine but I had already started building out a better system for him in my head. When he was done, I switched seats with him and opened up a new spreadsheet document...

15 minutes later, he had a 21st century version of his watch list that actually allowed him to perform side by side comparisons. He continued to perfect this new version over the next few weeks, culminating in his watch list service which takes all of that hard work from the weekend and turns it into something others can easily use too.

Measuring Success

Transparency and accountability are both highly valued when SCRUM is involved. This comes in handy if you have to send a progress report to your boss at the end of the week. In my dad's case, the only person he's accountable to is himself but he applied the same logic nonetheless.

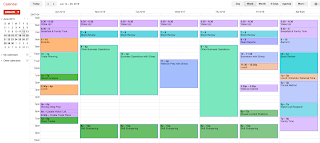

Realizing that his new watch list process saved him a few hours on the weekend, he asked himself if there were other ways he could be maximizing his time on a daily basis. So, we started to document his activity on a calendar and measured how successful he was with time management.

Once we dug into it, we realized that he was spinning his wheels on some things and not spending enough time on others. With that information in hand, we went about re-orienting his activity to keep it more results driven. His new calendar was far more organized and even gives him free cycles during the week!

Once we dug into it, we realized that he was spinning his wheels on some things and not spending enough time on others. With that information in hand, we went about re-orienting his activity to keep it more results driven. His new calendar was far more organized and even gives him free cycles during the week! Coming Full Circle

Thanks to SCRUM, what started as a project to help my dad get better at spreading his techniques transformed into realization of his funnel method, a better process for building his weekly watch list, and a better way to manage his time!

Feel free to follow me on Twitter and connect with me on LinkedIn! Consider me a resource on any project management questions you might have, I'm always happy to help!

Shiraz Hemani