When asked to name the greatest invention in human history, Albert Einstein simply replied “compound interest.”

Albert Einstein is also credited with saying: “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Compound interest or compounded returns is when your money makes money on previous returns or earns interest on interest. The compound interest formula is calculated by multiplying the principal amount by one plus the annual interest rate by the power of the number of periods the capital will be compounding at to get a total figure for both the principal and what accrues through compound interest. Subtract the principal if you just want the compound interest results.

Here is the exact compound interest formula that can used for calculating it:

Formula answer key:

A = Final amount

P = Initial principal balance

r = Interest rate

n = Number of times interest applied per time period

t = Number of time periods elapsed

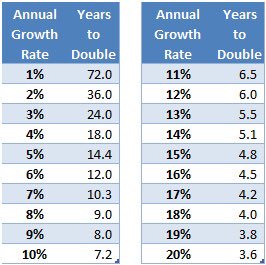

Here is the rate of compounding on capital based on annual return rate:

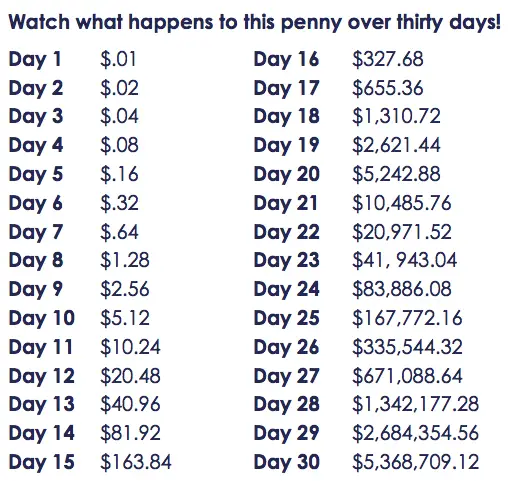

Here is the compounded returns when you double a penny for 30 days:

One of the most powerful thing you can do is grow capital by compounding it year over year and allowing it to grow to astounding levels.